There’s a new pair of shoes (I have a thing for shoes) on the website of one of my favourite shoe companies. They are so cute, all buttons and ribbons, and they are perfect for the season. Should I buy them?

These shoes, with their cute name, Betsy Buttons, are even on sale. I have shoes by this brand, they always fit right, I can wear them all day without hurting – I can’t lose, right? Except without the money of the Kardashians’, I can’t buy every pair of shoes that I want. I have to budget appropriately or I will have too much credit card debt or not enough to pay the bills that matter, like my mortgage, or heat – and it’s winter, so a roof and a furnace are more than just “nice to haves.”

These shoes, with their cute name, Betsy Buttons, are even on sale. I have shoes by this brand, they always fit right, I can wear them all day without hurting – I can’t lose, right? Except without the money of the Kardashians’, I can’t buy every pair of shoes that I want. I have to budget appropriately or I will have too much credit card debt or not enough to pay the bills that matter, like my mortgage, or heat – and it’s winter, so a roof and a furnace are more than just “nice to haves.”

So I created a budget. Sounds drab, and not fun. Reality is, if I want to have a lot of fun, I need to understand how much money fun will cost and where I’m going to get it from.

The truth is 1 in 10 Canadians live in poverty. There is no choice but to figure out a budget, when living below a poverty line that makes it difficult to afford rent, or food. Many Canadians also live paycheque to paycheque. Meaning that the majority are one paycheque away from becoming the 1 in 10. While I can’t solve the issue of how much money is in that paycheque, we can work toward understanding where that money goes and determining if there is a way to better utilize those funds.

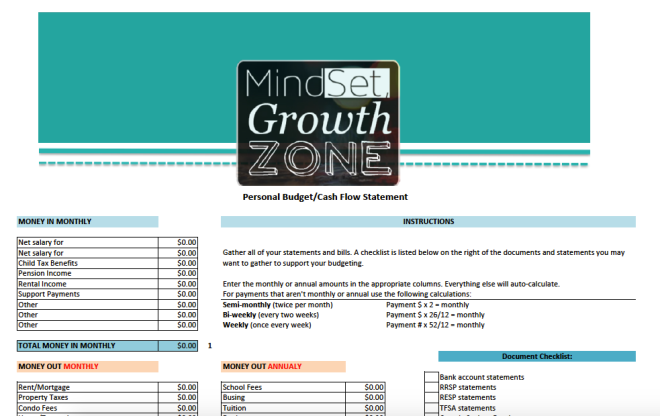

I have developed a Personal Budget for you to use to understand where your money is going. Included in the budget is a document checklist to help you gather everything in advance so that you can have a true picture of the flow of your funds. One of the ways that our money disappears is through the use of debit transactions. Did you know that Canada has the highest rate of debit transactions per person? The convenience is great as it allows you to access your funds for purchases, like groceries, school fees, and of course shoes. What also comes with that convenience though is less accountability of knowing where all of your money is being spent. If you are having a hard time keeping track of your money and paying the bills you might consider a different option:

- Once you have completed your budget leave enough money in your account to cover your pre-authorized debits, those bills that are automatically taken from your account.

- Review your budget and categorize the items, groceries, bills that you pay from your account, school fees, pet food, fun money.

- Label an envelope for each category and remove the cash from your account placing the appropriate amount in each envelope. If there is any money left over transfer it to a savings account that is not hooked up to your debit card.

- The money in the envelopes is your money for the month. This ensures that you stay within your budget and doesn’t leave open season for your debit card. It also reduces the amount of monthly transactions you are doing on your account, so you can probably change your service plan to one that covers only what you need.

- If you have enough money left in your fun envelope at the end of the month, go ahead, buy the shoes.

- And while you are at it, put your credit card on ice – literally. Put it in the freezer. This way it isn’t in your wallet, easy to use, but you have it in the event that you need to book a hotel room, or flight.

Below is a screenshot of the Personal Budget calculator. If you haven’t already completed it, last week I provided a GrowthZone Net Worth Statement, complete that now. These two documents, once done give you a great view of your current financial picture. Next week we’ll start looking at your future financial goals, and in the final week of the month you will have the tools to put together a financial plan. And if you like the shoes above and they fit in your budget they are from Poetic License.

To continue to receive tools and worksheets for your personal and professional growth join the Mind Set #GrowthZone today!

To continue to receive tools and worksheets for your personal and professional growth join the Mind Set #GrowthZone today!